Renters Insurance in and around Fort Morgan

Fort Morgan renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Cheyenne

- Denver

- Liberal

- Colorado Springs

- Kearney

- Scottsbluff

- Laramie

- Sydney

- Fort Collins

- Brighton

- Aurora

- Greeley

- Casper

- Colby

- Pueblo

Home Is Where Your Heart Is

Your rented apartment is home. Since that is where you spend time with your loved ones and make memories, it can be a wise idea to make sure you have renters insurance, whether or not your landlord requires it. Even for stuff like your stereo, desk, fishing rods, etc., choosing the right coverage can help protect your belongings.

Fort Morgan renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Safeguard Your Personal Assets

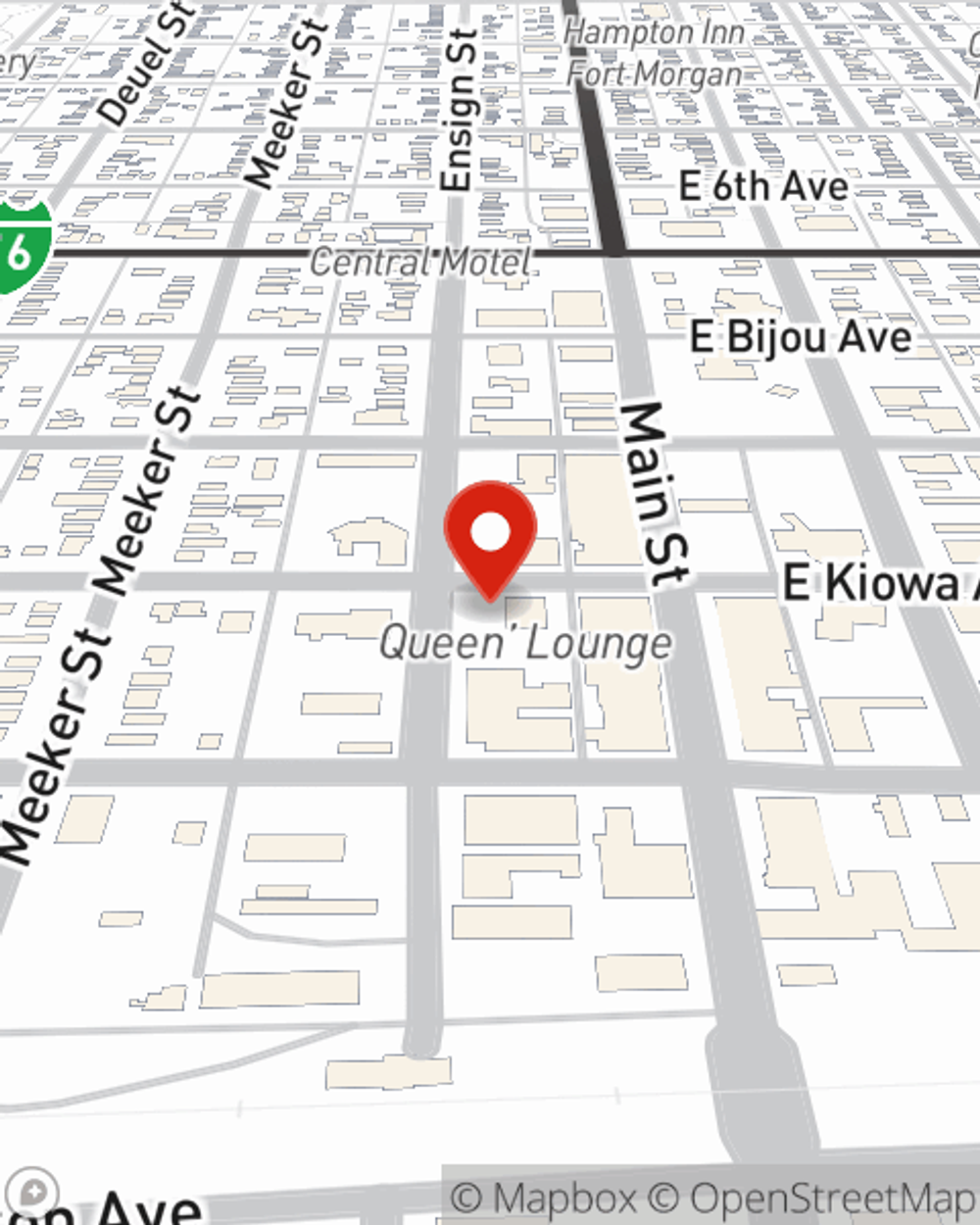

It's likely that your landlord's insurance only covers the structure of the condo or townhome you're renting. So, if you want to protect your valuables - such as a set of golf clubs, a recliner or a coffee maker - renters insurance is what you're looking for. State Farm agent Amy Grantham wants to help you understand your coverage options and protect yourself from the unexpected.

Don’t let the unknown about protecting your personal belongings stress you out! Visit State Farm Agent Amy Grantham today, and explore how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Amy at (970) 427-5273 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Amy Grantham

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.